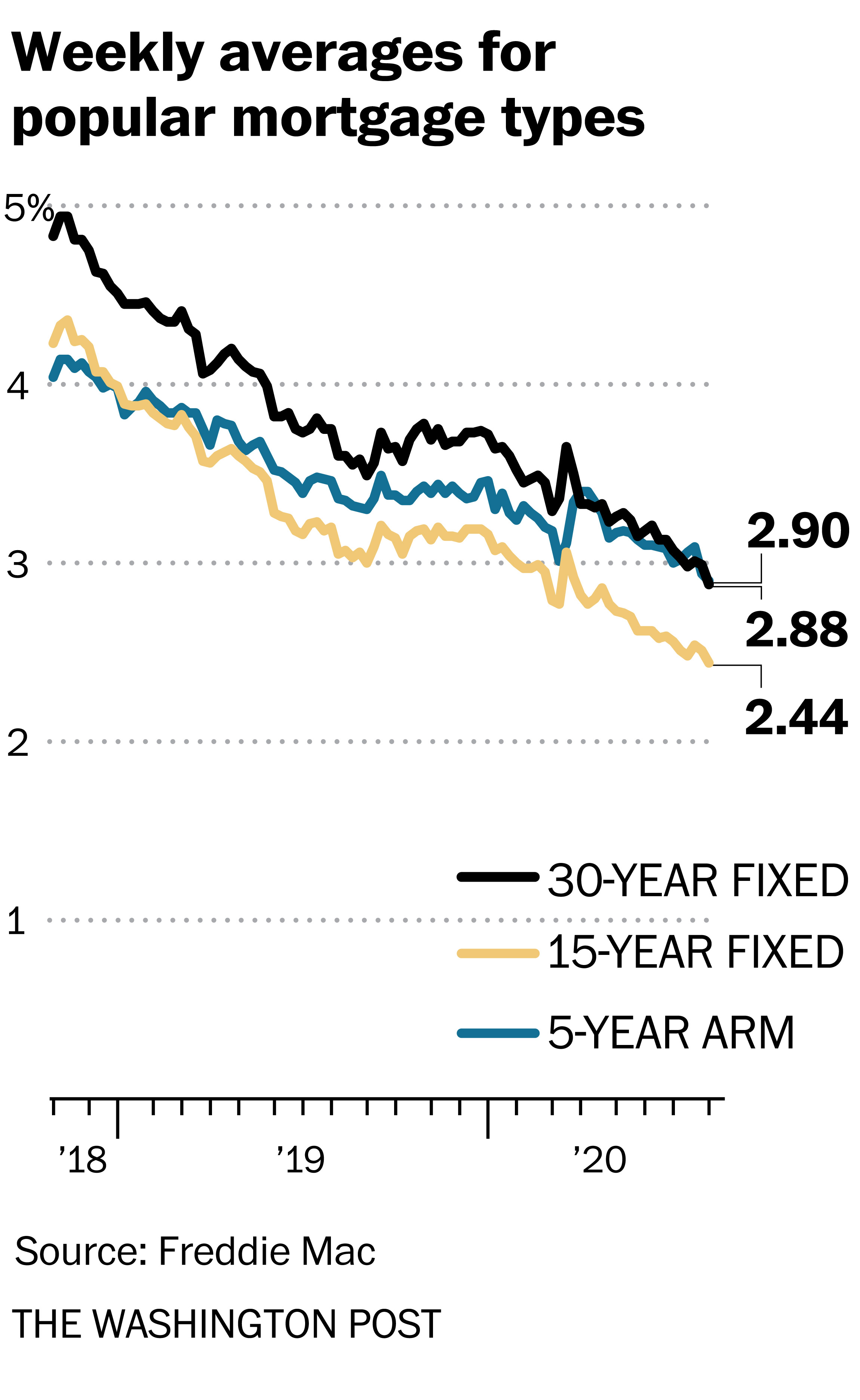

The Home loan Bankers Organization's latest Weekly Application reveals an uptick in applications for the week ending July 17, 2020. The Market Composite Index boosted by 4.1% from the previous week on a seasonally changed basis. Refinancing activity showed proceeded eagerness, enhancing by 5.3% from the previous week, while buying activity enhanced moderately by 1.8%. The MBA's 30-year fixed-rate home mortgage rate inched up by one basis indicate 3.2% from the record low gotten to in the previous week.

If rates rise, the price will Visit this link certainly be greater; if rates decrease, expense will certainly be reduced. Essentially, the customer has agreed to take the rates of interest threat. The minimal payment on an Alternative ARM can jump dramatically if its overdue principal balance strikes the optimum limitation on unfavorable amortization (commonly 110% to 125% of the original funding amount). If that takes place, the following minimum month-to-month payment will certainly be at a level that would totally amortize the ARM over its remaining term.

- If rate of interest are climbing or a constant, foreseeable settlement is very important to you, a fixed-rate mortgage might be the way to go.

- Ask the lending institution how much your repayment will certainly increase and also figure out whether you can still manage the loan at the higher price.

- " They don't wish to take that risk. They are taking care due to the fact that the market is so unpredictable. They can't forecast what it will be 5, 7, or ten years from now."

- Component of the Great Recession was activated by people with 2-year sub-prime ARMs who had depended on selling or refinancing-- prior to the practical set price period ended as well as the actually ugly flexible period began.

- In December 1995, a federal government study concluded that 50-- 60% of all Flexible Price Home Loans in the USA have a mistake relating to the variable rates of interest charged to the homeowner.

It means that the quantity you owe rises, also as you pay. It occurs when the amount you pay isn't adequate to cover the interest on your loan. The difference in between both is added to the equilibrium of your loan and interest is charged on that. The result is that you may owe even more a few months into the financing than you did at the start. Ask your lending institution if there is a chance of adverse amortization in your financing. The funding might be provided at the lender's conventional variable rate/base price.

Caps

The bright side is that there may be price caps in position, which shows an optimal rates of interest modification allowed during any kind of particular duration of the ARM. With that, you'll have much more convenient swings with each new rate modification. If a car loan doesn't satisfy these specific guidelines, then it will come under the nonconforming category. Yet beware of the possible risks prior to delving into a nonconforming lending! Although there are great reasons that customers might require a nonconforming mortgage, and also a lot of pioneers of these financings are reputable, lots of are not.

1 Arm Financing: Every Little Thing You Require To Understand

Consumers were frequently resulted in think that home rates would certainly proceed increasing, which would certainly allow them tap into the equity they had actually accumulated as well as roll over their growing financial debt right into a brand-new finance. Variable-rate mortgages supply introductory rates listed Homepage below prices for standard home loans, that usually change after 5 to ten years, at periods of one to 2 years. As of Friday, the rates of interest for an 5/1 adjustable-rate mortgage, as an example, was 4.68 percent for the very first 5 years, with yearly modifications, contrasted to 5.64 percent for a standard 30-year financing. The big disadvantage is that your regular monthly settlement can increase if rates of interest climb. Many individuals are surprised when the interest rate resets, although it's in the contract. If your income hasn't gone up, after that you might not have the ability to afford your home any type of longer, and you can lose it.

If you are disciplined regarding making these payments, you can in fact pay extra against the concept. By doing this, you will acquire higher equity in the house than with a traditional mortgage. These fundings are dangerous if you aren't prepared for the modification or the balloon payment. They also have all the same downsides of any kind of variable-rate mortgage. Your monthly settlement just goes toward rate of interest, and also none of the concept, for the initial 3 to five years.

Mortgageloan.com is an information and details service offering editorial Look at more info web content and directory information in the area of home mortgages and car loans. Mortgageloan.com is exempt for the precision of information or in charge of the precision of the rates, APR or financing info posted by brokers, loan providers or advertisers. It's worth noting that ARM rates can adjust down in addition to up, relying on market conditions.

Before obtaining an ARM, make sure to ask the loan provider which index will be utilized and check out how it has fluctuated in the past. There are likewise some crossbreed products like the 5/1 year ARM, which gives you a fixed price for the very first 5 years, after which the rate of interest adjusts when each year. An adjustable-rate mortgage is a type of home loan in which the rate of interest applied on the superior balance differs throughout the life of the lending. A fixed-rate home mortgage charges a collection interest rate that does not change throughout the life of the loan.

Leading 6 Mortgage Blunders

The size of the typical fixed-rate home loan last week country wide was $280,900. The dimension of the typical variable-rate mortgage was $688,400-- 2 and also a half times as large. Change regularity refers to the price at which an adjustable-rate mortgage price is changed once the preliminary period has actually expired. Another circumstance in which an ARM would certainly make good sense is if you can afford to accelerate the payments monthly by adequate to pay it off prior to it resets.

Simply put, the interest rate on the note precisely equates to the index. Of the above indices, only the contract rate index is used straight. " Most of my customers have been making use of ARMs," said Abby Ronquillo, owner of NetRealty in Corona. Andrea Riquier reports on real estate and also financial from MarketWatch's New York newsroom. Karan Kaul, an Urban Institute scientist, called the current surge in the size of ARMs "paradoxical" for their resemblances to the bubble period, however stated that things are really different now.