If you require to visit an assisted living home or treatment center for a period of one year or longer the financial institution can call the financing due and ask for you to pay back the loan. Financial institutions are understanding however there are some constraints concerning how much time you can be far from the home. A lot of banks would give you an expansion if you described your circumstance however its another reason to prevent a reverse mortgage.

- While a reverse mortgage may feel like an excellent way to access money in your gold years, it is essential to comprehend the realities of this sort of funding.

- Generally, when the last remaining debtor living in a reverse home loan home passes away, the FHA calls for financing servicers to send a letter revealing the equilibrium of the financing due.

- That compares with fewer than 3% of federally-insured conventional mortgage that are seriously delinquent.

- Take a look at the complying with chart, which reveals the approximated market value of Barry's property throughout 20 years and the passion to equity ratio.

- This is normally the most budget-friendly sort of reverse home loan.

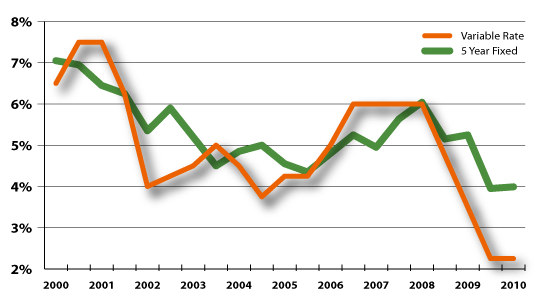

The primary danger is that your funding principal increases as the rate of interest repayments are contributed to it, as well as interest rates for reverse mortgages do not come low-cost. At the time of writing, House Capital had reverse home mortgages with a variable rate of 5.15% and also a comparison price of 5.21%. In some cases described as "life time financings", reverse mortgages use the equity in your home as safety for a loan. In contrast to regular car loans, reverse home loan rate of interest is included in the loan principal and also the whole great deal is settled when you sell your house or pass away.

Where To Obtain A Reverse Home Mortgage

If you are within 6 months from your next birthday celebration, I will automatically compute you a year older. A normal home mortgage substances on a lower figure monthly. If you fall short to maintain any one of the lending terms-- missing out on a property tax repayment, not properly keeping the residence, etc-- you may need to settle the home loan early. A home owner that might or else need to scale down can make use of a reverse mortgage to stay in her house.

When Is Taking A Reverse Mortgage A Negative Concept?

That will certainly drop to 58%, according to the Wall Street Journal. That suggests you or your survivors will certainly never ever owe greater than what the house deserves. If that's unworthy enough to cover the balance of your funding, mortgage insurance coverage pays the distinction. In 2015, the CFPB fined AAG $400,000 after it determined old advertisements including Fred Thompson wrongfully claimed consumers could Helpful site href="https://www.globenewswire.com/news-release/2020/06/25/2053601/0/en/Wesley-Financial-Group-Announces-New-College-Scholarship-Program.html">https://www.globenewswire.com/news-release/2020/06/25/2053601/0/en/Wesley-Financial-Group-Announces-New-College-Scholarship-Program.html not shed their houses. Several others wound up losing money with a reverse home mortgage.

Can You Obtain Versus An Unfavorable House Equity?

As a result of start-up costs as well as greater interest rates, reverse home mortgages are more pricey than standard lines of credit or mortgages. Early payment of all or a section of the quantity borrowed can subject you to prepayment fines. Loaning against your house will affect the quantity readily available to pass on to your beneficiaries. Many elders experience a considerable income reduction when they retire, and regular monthly home loan repayments can be their largest expense.

If the funding is an HECM, a certified making it through partner can continue to be in the home, however the lender won't launch any more cash. To certify to stay in the residence, the partners must have been married when the car loan was signed and satisfy other standards. Below are a few situations when getting a reverse home loan might not be the most effective selection.

If you're 62 or older, you can qualify for an HECM finance and utilize it for any type of function. Some folks will utilize it to spend for costs, getaways, residence remodellings or perhaps to pay off the remaining amount on their regular home mortgage-- which is nuts! The most common reverse home mortgage is the Home Equity Conversion Home Loan. HECMs were created in 1988 to help older Americans make ends fulfill by allowing them to take advantage of the equity of their houses without needing to leave. The Home Equity Conversion Mortgage program also enables reverse mortgages on condos authorized by the Division of Real Estate as well as Urban Development.

Reverse home mortgages are non-recourse in nature and therefore can not move financial obligation to your beneficiaries or estate. A reverse home mortgage can supply lots of benefits to senior customers. The Demand will provide you a balance that consists of all rate of interest and also any type of other fees called for to close the car loan and record last documents. I could just start guessing what the factors would certainly be why your available profits were so low at best timeshare exit companies this moment.